Loan Risk Prediction/Credit Worthiness

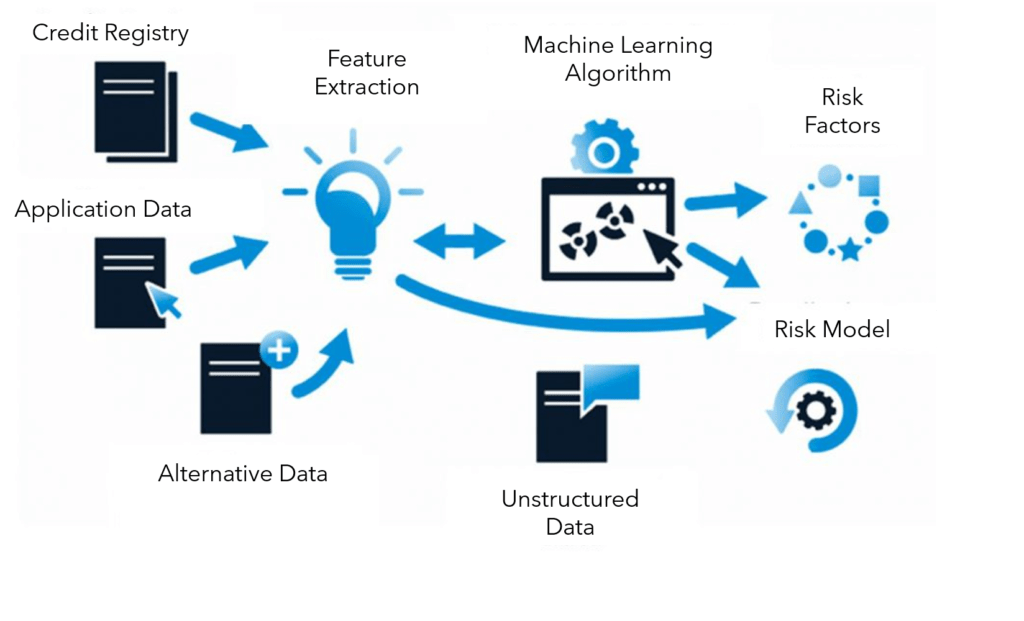

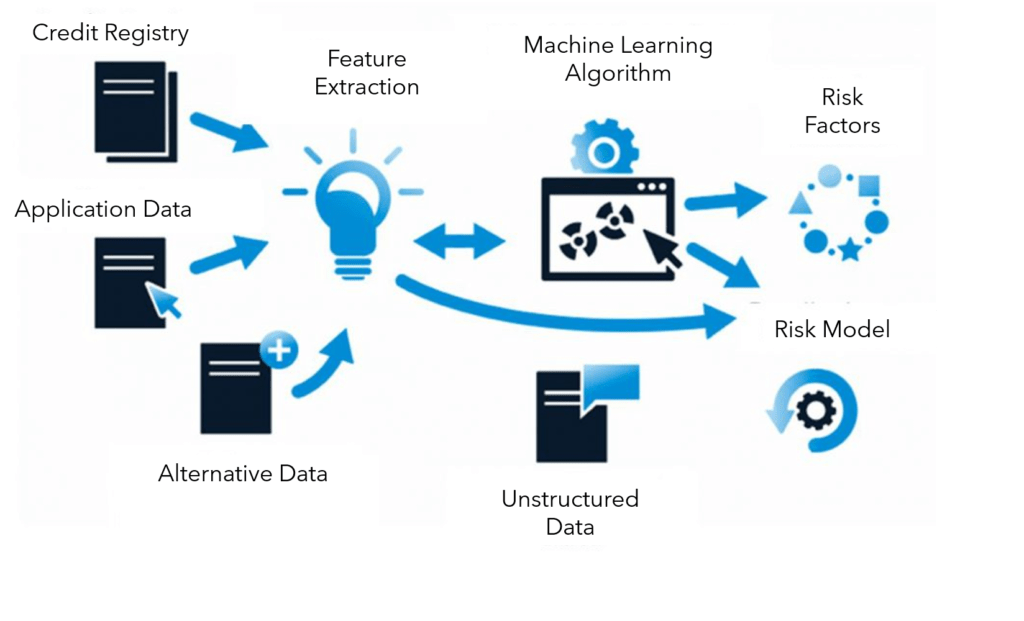

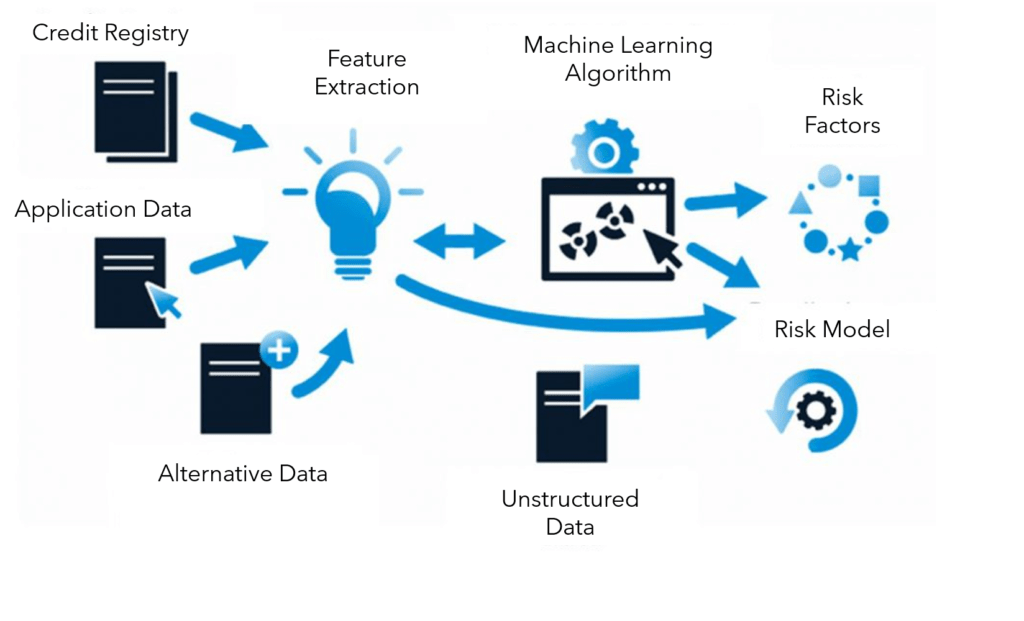

Financial institutions play a crucial role in offering various services, including loans and leases. However, when a borrower defaults on a loan and fails to repay the borrowed amount, it leads to financial losses for the institution. Therefore, it becomes essential for financial institutions to evaluate the risk of non-payment during the loan application process. At our company, we leverage cutting-edge techniques, such as Google’s wide and deep model, to develop a data-driven approach. This advanced model analyzes applicant data to assess the likelihood of default and provides recommendations on whether to accept or decline the application. By implementing this model, financial institutions can potentially increase loan approval rates while effectively mitigating the risk of loan defaults by borrowers.